Learning about Medicare Advantage Plans

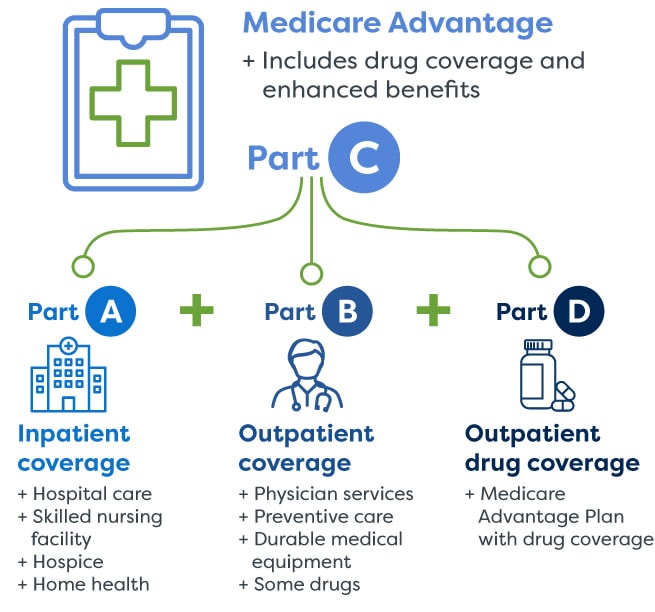

Medicare Advantage Plans function as provided by independent Insurance companies that work alongside Medicare to offer Part A along with Part B benefits in one coordinated model. Unlike Original Medicare, Medicare Advantage Plans often feature supplemental coverage such as prescription coverage, dental care, eye care services, and also wellness programs. Such Medicare Advantage Plans operate within established service areas, which makes location a key consideration during review.

Ways Medicare Advantage Plans Differ From Original Medicare

Original Medicare provides broad doctor choice, while Medicare Advantage Plans often rely on managed provider networks like HMOs along with PPOs. Medicare Advantage Plans can require referrals even in-network facilities, but they often counter those restrictions with structured out-of-pocket amounts. For many beneficiaries, Medicare Advantage Plans provide a middle ground between affordability and also added benefits that Original Medicare alone does not typically include.

Who Should Consider Medicare Advantage Plans

Medicare Advantage Plans appeal to beneficiaries looking for organized healthcare delivery also potential financial savings under one unified policy. Seniors living with ongoing conditions often select Medicare Advantage Plans because coordinated treatment Policy National Medicare Advantage Plan options structures reduce complexity in treatment. Medicare Advantage Plans can additionally appeal to enrollees who desire bundled services without managing several additional policies.

Eligibility Requirements for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, enrollment in Medicare Part A & Part B required. Medicare Advantage Plans are accessible for the majority of individuals aged 65 with older, as well as under-sixty-five individuals with qualifying disabilities. Participation in Medicare Advantage Plans relies on residence within a plan’s coverage region not to mention timing aligned with authorized enrollment periods.

Best times to Choose Medicare Advantage Plans

Proper timing has a vital role when selecting Medicare Advantage Plans. The Initial sign-up window surrounds your Medicare eligibility date together with allows first-time selection of Medicare Advantage Plans. Overlooking this period does not automatically remove access, but it often change future opportunities for Medicare Advantage Plans later in the calendar cycle.

Annual plus Qualifying Enrollment Periods

Every autumn, the Yearly enrollment window permits enrollees to change, remove, and also add Medicare Advantage Plans. Special enrollment windows are triggered when life events occur, such as relocation or coverage termination, making it possible for adjustments to Medicare Advantage Plans outside the typical timeline. Recognizing these windows supports Medicare Advantage Plans remain available when situations shift.

Ways to Review Medicare Advantage Plans Properly

Comparing Medicare Advantage Plans requires care to more than monthly premiums alone. Medicare Advantage Plans vary by network structures, out-of-pocket spending limits, prescription lists, as well as benefit rules. A careful review of Medicare Advantage Plans supports matching healthcare priorities with coverage models.

Costs, Benefits, and Network Networks

Recurring costs, copayments, also annual limits all define the overall value of Medicare Advantage Plans. Some Medicare Advantage Plans offer minimal premiums but increased cost-sharing, while alternative options prioritize consistent expenses. Provider access also varies, so making it necessary to verify that preferred doctors accept the Medicare Advantage Plans under evaluation.

Drug Benefits & Extra Services

Numerous Medicare Advantage Plans include Part D drug benefits, simplifying prescription management. In addition to prescriptions, Medicare Advantage Plans may cover fitness programs, transportation services, with over-the-counter benefits. Evaluating these extras helps ensure Medicare Advantage Plans align with daily healthcare priorities.

Enrolling in Medicare Advantage Plans

Sign-up in Medicare Advantage Plans can occur digitally, by telephone, with through authorized Insurance Agents. Medicare Advantage Plans need precise individual information together with verification of eligibility before coverage activation. Finalizing enrollment properly avoids delays and also unplanned coverage gaps within Medicare Advantage Plans.

Understanding the Importance of Authorized Insurance Agents

Authorized Insurance professionals help interpret coverage details along with explain differences among Medicare Advantage Plans. Consulting an expert can clarify provider network restrictions, coverage boundaries, as well as costs tied to Medicare Advantage Plans. Professional support frequently simplifies decision-making during sign-up.

Typical Mistakes to Watch for With Medicare Advantage Plans

Missing doctor networks details ranks among the most errors when selecting Medicare Advantage Plans. An additional issue centers on focusing only on premiums without accounting for overall expenses across Medicare Advantage Plans. Examining plan documents carefully reduces misunderstandings after sign-up.

Reviewing Medicare Advantage Plans Each Year

Healthcare requirements shift, plus Medicare Advantage Plans adjust every year as well. Reviewing Medicare Advantage Plans during open enrollment periods enables changes when coverage, expenses, along with doctor access change. Regular review ensures Medicare Advantage Plans matched with current healthcare needs.

Reasons Medicare Advantage Plans Keep to Grow

Enrollment trends demonstrate increasing interest in Medicare Advantage Plans across the country. Additional coverage options, structured out-of-pocket limits, as well as coordinated healthcare delivery contribute to the popularity of Medicare Advantage Plans. As offerings increase, well-researched evaluation becomes even more valuable.

Ongoing Benefits of Medicare Advantage Plans

For a large number of beneficiaries, Medicare Advantage Plans deliver stability through integrated benefits also organized healthcare. Medicare Advantage Plans can lower administrative complexity while encouraging preventative services. Identifying appropriate Medicare Advantage Plans creates confidence throughout later life years.

Compare also Enroll in Medicare Advantage Plans Today

Making the right step with Medicare Advantage Plans opens by reviewing current choices as well as checking qualification. Whether you are currently entering Medicare with reviewing current coverage, Medicare Advantage Plans offer flexible solutions designed for different healthcare needs. Explore Medicare Advantage Plans now to find a plan that supports both your health plus your budget.